Week 5: Introduction to Investing

Investing can seem like an intimidating prospect for beginners, but those who take the time to understand the basic concepts and principles will gain more money in the long haul.

Investment Risk Ladder and Different Types of Investments

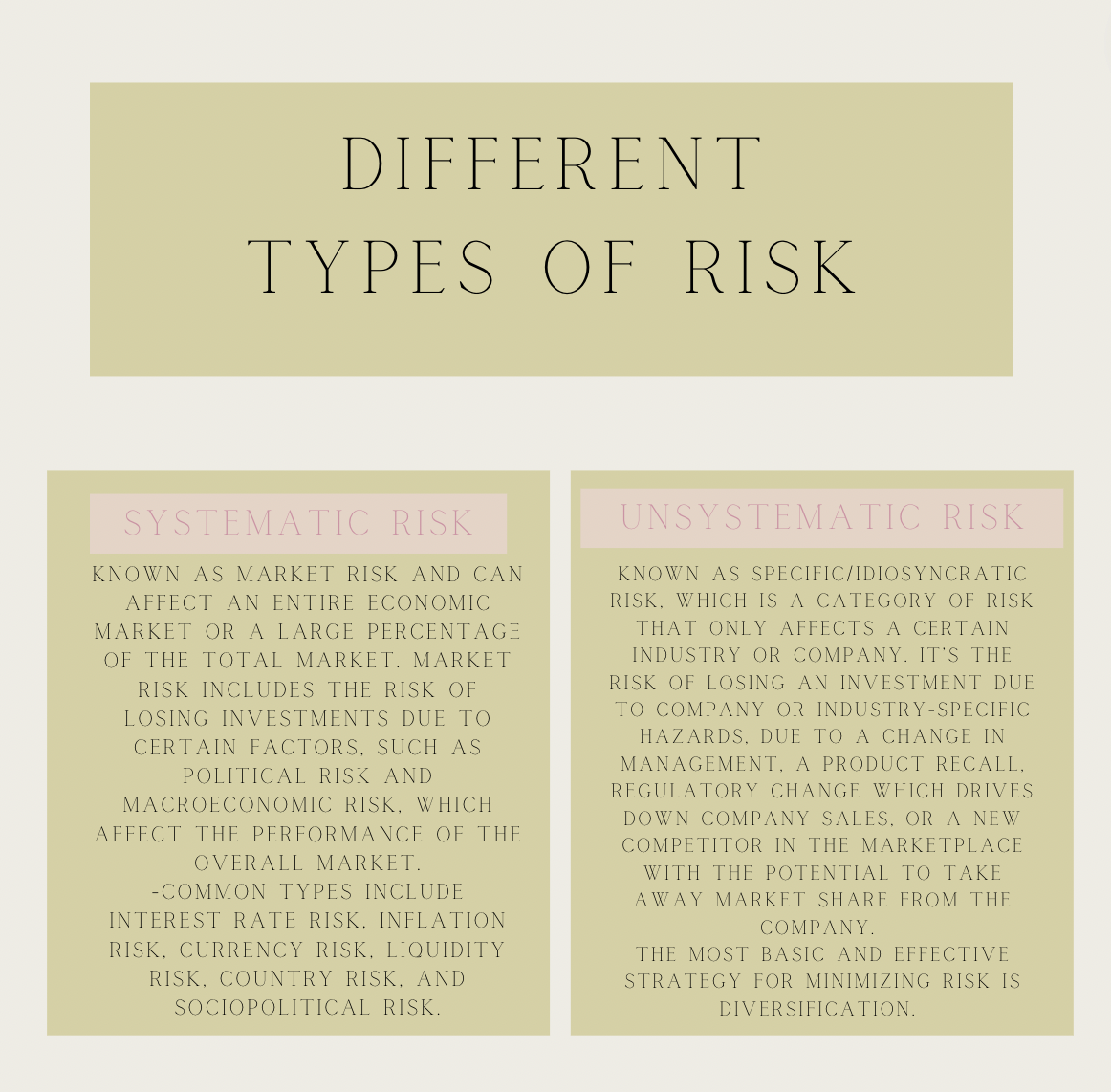

But first, let’s make sure we understand what risk is. Risk defined in financial terms as the chance that an outcome or investment’s actual gains will differ from an expected outcome or return.

(Just like how you take a risk betting on your favorite sports team to win. You bet on them, because you expect they will win, but your expectation could differ from what actually happens.)

In finance, risk is measured by standard deviation.

Standard deviation measures the dispersion of a dataset relative to its mean. It is calculated as the square root of the variance. This is measuring the relative riskiness of an asset.

Learning the risks that can apply to different scenarios and some of the ways to manage them will help all types of investors to avoid unnecessary and costly losses.

Each individual has their own risk profile, which is an evaluation of an individual's willingness and ability to take risks. A corporation's risk profile attempts to determine how a willingness to take on risk (or an aversion to risk) will affect an overall decision-making strategy.

*The greater the amount of risk an investor is willing to take, the greater the potential return.

A U.S. Treasury bond is considered one of the safest investments and when compared to a corporate bond, provides a lower rate of return. A corporation is much more likely to go bankrupt than the U.S. government.

Treasury bonds (T-bonds): government debt securities issued by the U.S. Federal government that have maturities greater than 20 years. T-bonds earn periodic interest until maturity, at which point the owner is also paid a par amount equal to the principal.

*It’s part of the U.S sovereign debt, which is debt issued by the government of an independent political entity, usually in the form of securities.

*Fun fact: If you thought credit scores stopped mattering, you’d be intrigued to know several private agencies often rate the creditworthiness of sovereign borrowers and the securities they issue.

Riskless securities: while no investment is fully free of risks, there are certain securities that are considered ‘risk-free’ or ‘riskless’

Examples of these investments include CDs, government money market accounts, and these US treasury bills. The 30-day U.S treasury bill is viewed as the baseline of risk-free security as it’s backed up by the U.S government, given a short maturity date, and has minimal interest rate exposure.

With that being said, time horizons play a key role in influencing risk assessment and management. If an investor needs funds to be accessible immediately, they’re likely to invest in high risk in riskless securities as opposed to high risk investments that cannot be liquidated as quickly.

The Different Investment Assets

Cash: cash bank deposits are the simplest and most easily understandable investment asset, as it gives investors knowledge on the interest they’ll earn, while also guaranteeing they’ll get their capital back.

*but keep in mind, the interest you will earn from cash socked away in a savings account will typically give you a larger return in interest than if you were investing (due to inflation). For example, a CD will provide higher interest rates, but could also keep your money locked up for a long period of time, so if you’re looking for a faster guarantee, a CD might not be the best option for you (they are known as less liquid instruments)

Bond: debt instrument representing a loan made by an investor to a borrower. It usually involves a corporation or government agency, where the borrower will issue a fixed interest rate to the lender in exchange for using their capital. Bond details include the end date when the principal of the loan is due to be paid to the bond owner and usually include the terms for variable or fixed interest payments made by the borrower.

Mutual fund: type of investment where more than one investor pools their money together to purchase securities. Most mutual funds have a minimum investment of between $500 and $5,000, but some don’t have a minimum at all. Even a relatively small investment provides exposure to as many as 100 different stocks contained within a given fund's portfolio.

Exchange-traded funds: similar to mutual funds, but they trade throughout the day, on a stock exchange. In this way, they mirror the buy-and-sell behavior of stocks. This also means that their value can change drastically during the course of a trading day. This can include anything from emerging markets to commodities, individual business sectors such as biotechnology or agriculture, and more.

(WE WILL GET INTO THIS MORE IN WEEK 3: MUTUAL FUNDS AND ETFS)

Stocks: Shares of stock let investors participate in a company’s success via increases in the stock’s price and through dividends. Shareholders have a claim on the company’s assets in the event of liquidation (that is, the company going bankrupt) but do not own the assets.

If none of those seem like suitable investments for you, let’s look more into alternative investments which include real estate (as well as real estate investment trusts), hedge funds, private equity funds, and commodities.

(WE WILL GET INTO THIS MORE IN WEEK 2: STOCKS AND BONDS)

Understanding liquidity better

Generally, land and real estate are considered among the least liquid assets, because it can take a long time to buy or sell a property at market price. Money market instruments are the most liquid, because they can easily be sold for their full value.

How to invest safely and effectively

Investors should start with simple investments and then expand their portfolios incrementally. New investors should specifically start with mutual funds or ETFs, as with mutual funds, one small investment can open up many options and with ETFs, you get a more cost-effective return. Then slowly, you can move on to stocks, real estate, and other investments.