Week 1: Introduction to personal finance

Personal finance is exactly what it sounds like! It’s the managing of day-to-day finances, as well as YOUR financial future. I’m here to give you tips on how to manage these finances while still living your life!

-managing, saving, and investing money (budgeting, banking, insurance, mortgages, investments, retirement, tax, estate planning)

-individual goals and desires (planning financially); helps you distinguish between good and bad financial decisions

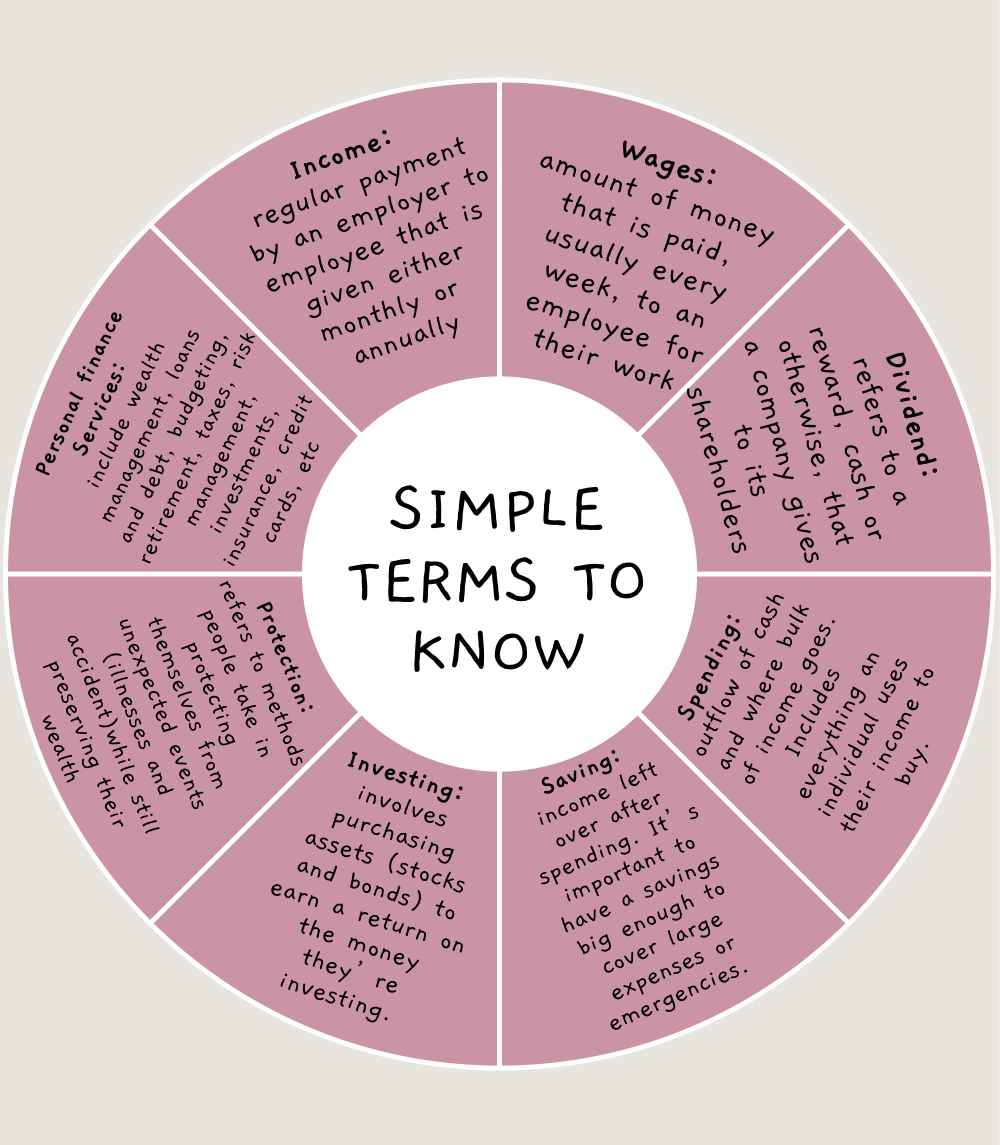

-core areas of managing personal finance including income, spending, savings, investments, and protection

-smart personal finance including budgeting efficiently, creating an emergency fund, paying off debt, using credit cards wisely, saving for retirement, etc.

-short-term and long-term goals (planning for retirement/saving for your child’s college education)

Personal finance

Personal Finance Skills

1. Financial prioritization

This means you are looking at your finances on a regular basis! Determine what keeps the money flowing in, not out, and implement those efforts strongly.

2. Assessing the costs and benefits

Develop a list of ideas that will bring other ways for you to make money, whether that be a side business or an investment idea. (you want to run your finances like a business)

3. Restraining your spending

Don’t spend more money than you make! Learning how to restrain spending on non-wealth building assets or your debt-saving goals until after you’ve met your monthly savings is the most crucial part of building a net worth for yourself.

Simple Strategies

Always remember the sooner you start saving, the better.

1. Know your income

It’s important to know how much you’re taking home everyday. Duh! I know it must seem like that, but you’d be surprised that many people forget that they’re not going to get all the money they make from their income. It’s important to know how much you’re taking home everyday AFTER tax has been deducted (AKA your net income!)

2. Develop a budget

Everyone has different financial goals they’d like to meet, but if you’re someone who’s just receiving their first paycheck, the best strategy I’d recommend using would be…

The 50/30/20 budget: 50% of your paycheck goes towards living essentials such as rent, utilities, groceries, 30% goes towards entertainment such as shopping, dining out, going out with friends, and 20% goes towards building your financial future in a savings account for retirement or an emergency fund

This budgeting strategy will teach you how to manage your money just starting off, but still live your life! (which we’ll get more into in week 2: budgeting and saving)

3. Limit and reduce debt

The key to limiting and reducing your debt is simply not spending more than you have!

Minimizing these repayments to “interest only” frees up money from your income that you’re able to invest in elsewhere and/or put into your retirement savings while you’re still young and will get the maximum benefit of compounding interest

Let’s talk a bit about compounding interest!

The simple definition of compound interest is the interest earned on savings calculated on both the initial and accumulated interest

Let’s break that down now:

Description: Compound interest grows faster than simple interest, as compounding multiplies money at an accelerated rate and the greater the number of compounding periods, the greater the compound interest is

Formula: total amount of principal and interest in future (or future value) minus principal amount at present (present value)

[P(1+i)n] - P

P[(1+i)n-1]

EX. A 3 year loan of $10,000 at an interest rate of 5%:

10,000[(1+0.05)3-1] = 10,000 [1.157625-1] = $1,576.25 making that $10,000 you invested worth $11,576.25 at the end of the 3 years

Graph:

The power of compound interest is that it’s growing at an ever-accelerating rate the more frequently you compound it!

Periods of time you can compound:

Annually - calculating interest to an investment once a year

Semi-annually - calculating interest based on a previous terms calculation; happens twice a year

Quarterly - every 3 months; happens four times a year

Monthly - once a month; happens twelve times a year

Daily - interest accumulated daily and is calculated by charging interest on principal plus interest earned daily (ex. you invest $100 and earn 1% annually, you’d earn 0.00274% daily (1%/365), which at the end of 365 days would earn you $101.01)

Continuously - interest calculated over an infinite number of periods, rather than specific amount of periods

Examples:

Savings and money market accounts: daily compounding

Certificate of deposit (CD): daily or monthly compounding

Series I bonds: semi-annually (every 6 months) compounding

Loans: monthly compounding

Credit cards: daily compounding

4. Monitor your credit score

Credit cards, as we know, are different from debit cards. When you purchase something with a credit card, you’re allegedly borrowing money, meaning you will have to pay it back. The most important thing you can do to keep your credit score up is to only borrow what you know you can repay!

Tip: If you feel you can’t be trusted with a credit card right away, start with a debit card as it’s pulling directly from money you already have.

We’ll talk more about credit reports, FICO scores, and how to establish good credit in week 4: introduction to credit

5. Plan for your future and buy insurance

Planning for the future can sound scary, but it’s actually the most beneficial thing you can do when you first start making money. The longer you wait to buy insurance, the more expensive it gets. You want to specifically look for insurance that reduces your premiums: auto, home, life, disability, and long term care.

With all the new medical technology and innovations, people are living longer! Living longer comes with wanting to do more things, and wanting to do more comes with needing more - you guessed it, money!

In order to make sure you have enough money to live a comfortable life after retiring you must have…

(what I'm giving you now!), financial awareness

Investing strategies for your age

A balanced portfolio

Saving and budgeting in a world of inflation

Financial planning and caring for when starting a family

Estate planning (if you’re passing on your savings to your children: trust, assets, etc.)

What’s great about setting up a retirement account is that you’re able to have money go automatically from your paycheck, but not have to pay income tax on the money!

Tip: set up this account as soon as you start generating an income.

We will discuss trust, assets, living wills, etc and work on understanding the different accounts you can open to best save your money in week 2: budgeting and saving

And just like that we’re done with our first week of our 6 month plan! I hope you will implement these strategies into your daily life and take into account my tips for maintaining strong personal finance. Remember we’re just getting started and we have a lot more content to cover!