Week 4: Introduction to credit

Remember all the way back to week 1:Introduction to personal finance where we talked strategies? Well, if you don’t, monitoring your credit score is one of the biggest things to maintain successful personal finance.

Terms To Know

First, what is a credit score?

A credit score is a 3 digit number that rates your credit worthiness. These are called FICO scores, which is a credit score created by Fair Isaac Corporation and it takes into account five areas to determine an individual’s creditworthiness: payment history, current level of indebtedness, types of credit used, length of credit history, and new credit accounts.

*IMPORTANT:

-it’s used in 90% of mortgage application decisions in the U.S.

-the scores range from 300-850, scores 670-739 are considered “good”

-you can improve FICO score by paying bills on time, using less than 30% of available credit, and using different types of credit

*TIP: subscribe to agencies that will give you regular credit score updates, the “big three” major credit bureaus: Equifax, Experian, and TransUnion all allow you to obtain free credit reports once a year.

Your creditworthiness is determined by your FICO score, as it’s a measure of a borrower’s risk to a lender. The best way to improve your creditworthiness is by making payments on time and reducing your debt. Your credit report documents your creditworthiness for things such as how to obtain a lease, mortgage, or other type of financing.

Credit report: breakdown of your credit history prepared by a credit bureau (collects financial information about you as well as creates these reports based on the information). This is used to determine your creditworthiness by looking at your bill-paying habits and includes your personal information, details on lines of credit, public records of bankruptcies, etc.

So why’s it important to have good credit and creditworthiness?

Well, if you’re ever in need of a loan from the bank, your creditworthiness will tell the creditor how suitable you are for that loan. The decision of whether they will provide you with a loan or not is based on how you’ve dealt with credit in the past, so it's extremely important you maintain a higher score.

The more creditworthy you are, the more likely you’ll be approved for better interest rates too, which ends up saving you a significant amount of money. Other benefits include employment eligibility, insurance premiums, business funding, and professional certifications or licenses.

How to improve your creditworthiness

Pay your bills on time!

Paying your bills on time is the key to having good credit. It’s also recommended you pay more than the minimum monthly payment to pay your debt down faster and improve your credit utilization (beneficial to your credit report)

The minimum monthly payment lowest amount a customer can pay on a revolving credit account per month to remain good with their credit card company.

*However, keep in mind, those who pay ONLY the minimum monthly payment, will end up taking longer to pay off all their balances and will pay higher interest expenses (will lose more money than those who pay above the minimum monthly payment)

Lenders are more likely to approve your loans when you have a higher credit score, and will most likely decline your loan if you have a lower credit score. It’s also said that you get better interest rates when you have a higher credit score which can save you money in the long term.

Here are the general ranges:

Excellent: 800–850

Very Good: 740–799

Good: 670–739

Fair: 580–669

Poor: 300–579

If you remember back to our personal finance strategies from back in week 1? Well, if you don’t, I’m here to refresh your memory!

One of the strategies for maintaining good personal finance was monitoring your credit score!

Key takeaways:

Pay bills on time! (it affects your credit score most)

Get a credit card as soon as you start working your first job (even if you’re making chump change) to build up your credit score, so that you don’t appear as “new” to lenders

Think before you spend: do you need this?, can this money go into your savings instead?, is this the best of your credit utilization?

Tips to improve credit score:

Increase your credit line: if you have multiple credit card accounts, look into getting a credit increase. A credit increase is beneficial if you have an account in good standing, as you’ll be granted an increase in your credit limit depending on the amount. Be sure to not get carried away in spending this amount, so you’re able to maintain a lower credit utilization rate. Instead, try paying off lingering debt.

Don’t close a credit card account: if you aren’t using a credit card, it’s best you just stop using it instead of closing the whole account. Depending on the age and credit limit of a card, it can hurt your credit score if you close an account.

Work with one credit card company: if you’re someone who’s overwhelmed by debt and have questionable items on your credit report, you can work with a credit card company to remove these items from your report in order to improve your credit score in the long run.

Best credit repair companies:

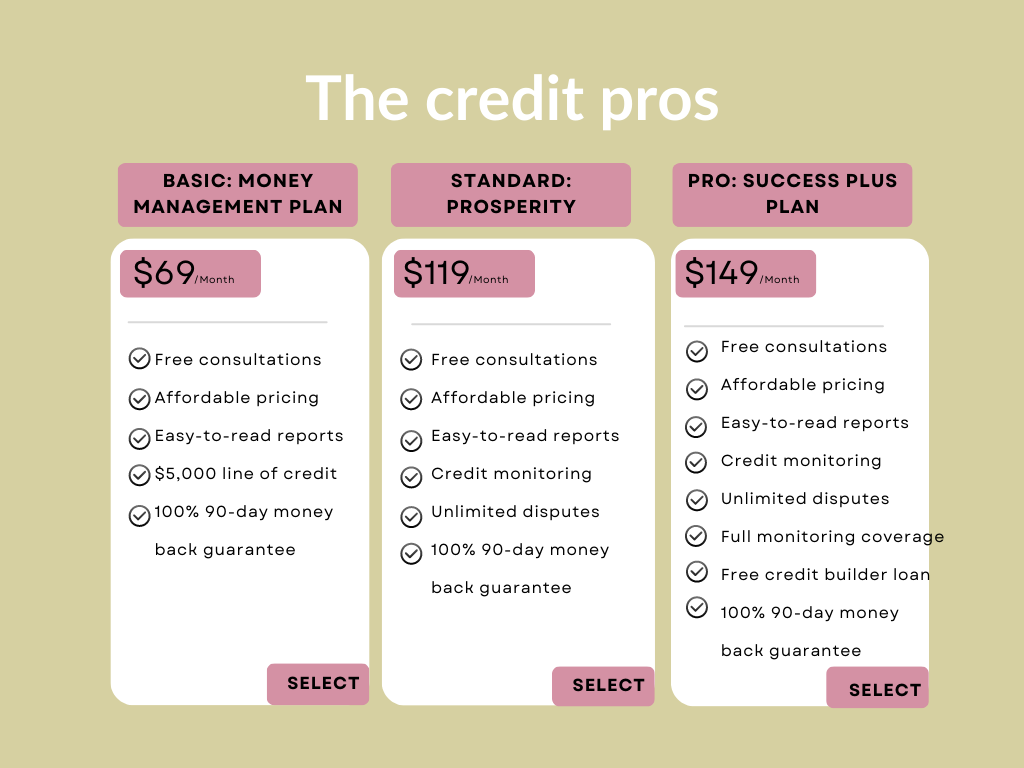

Best for credit repair: The Credit Pros

Prospective clients get a free credit repair consultation to help them decide which of the company's three packages is best for them

The three packages include…

The success plus plan offers a significant amount of assistance, will offer credit builder loans (which are reverse loans; you make payments first and prove you’re able to pay on time and then you’ll get the money - 100% 90-day money back guarantee).

Keep in mind, the $5,000 line of credit is available with the Money Management plan; this is less useful than the credit builder loan because it only reports to Experian. That means it won't show up on your TransUnion and Equifax credit reports. And this line of credit is quite limited, as it can only be used for purchases with the National Credit Direct store).

Best simple credit repair: Credit Saint

Credit Saint offers a comprehensive package for simple credit repair needs and is designed for those who may not require all features of the more expensive plans. The company offers free consultation, an option to cancel anytime, a 90-day money-back guarantee, and three packages to choose from.

The three packages include…

Basically, your credit score probably has the biggest impact on your financial life, as you’re more likely to qualify for loans and receive better terms on your interest that can save you a lot of money. This actually saves you much more money in the long run, even if that means you might have to watch it more closely when you’re younger.

And just like that, we’ve completed 1 month of our 6 month plan. Time to get into all those REAL money-making activities!